Recent developed index insight towards comparative analysis towards each domestic individual tax in

- Chao Zheng (Justin,Dwood)

- Oct 30, 2018

- 3 min read

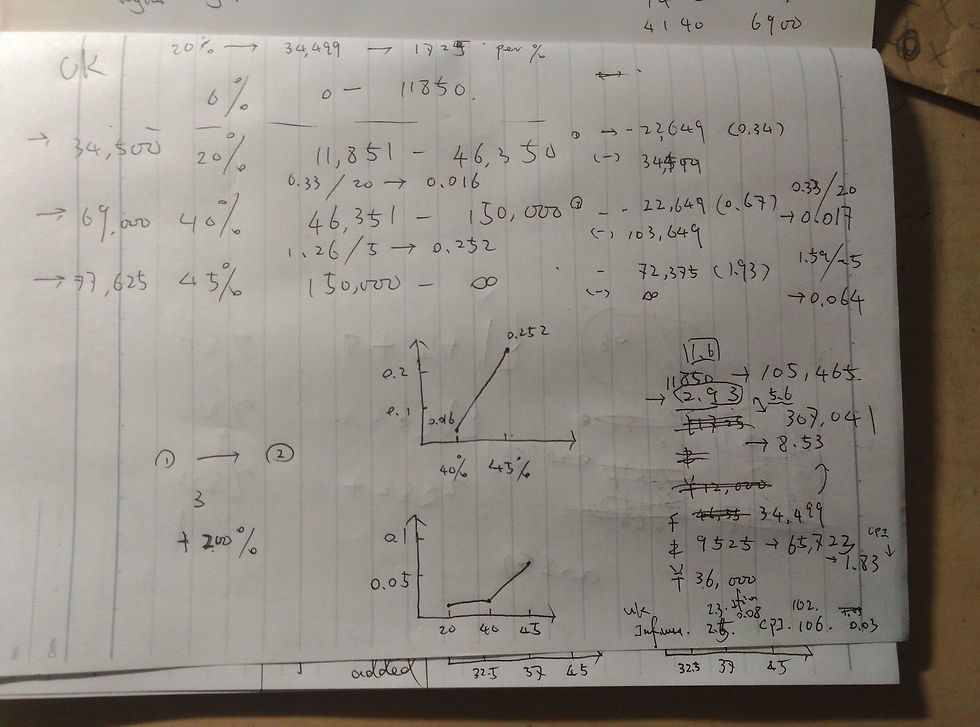

Recently I have developed a new index for directly comparing the different domestic individual Tax rate from different country . This method was based on the reflection of the changes of the 1% tax charge in every inerval of divided groups of the tax changing. hence ,the ratio could directly to be compared around world with any nationa's domestic index under such settings.

Below , it is the US individual tax rate , family tax rate, and Chinese individual tax rate and business tad rate for comparative studies

US individual tax and family tax

Chinese individual tax and business level

Have to reveal , I have invented a new index to contrast the every country domestic tax directly on ratio level, with comparation on Inflation and rate and CPI for their approach between the poor (basic range) and price level

What I mean about CPI mentioned above is that American had 1.8 time wider range amount transited as same currency as rmb as computation for the basic tax rate for the poor , and the inflaion rate between China and US is nearly similar. But due to CPI which had rising 2.44 higher than rmb , hence this make his tax in shortage of 0.6 poor

That is what I mean about the poverty in CPI , hence suddenly we started to concern the justification of price level. the justification of the price level might be laind on VAT, exchange rate and monetary value under such purchase power.

Then it comes as the individual tax race from UK and Australia for comparative studies

Individual tax rate exploration under lowest average rate of one percent of such change for observation in UK and Australia individual tax rate , after the analysis of Chinese and american tax rate

Hence here comes a assumption towards there might exist a inherent relationship between individual tax rate, purchase power, exchange rate .

In my assumption UK and Australian model might be less sensitive towards exchange rate compared with the model in US and China.

Also, as the comparative analysis, the tax system held in UK might be the one which is best holding wider range for the poor. no matter is it the part which has been exempted , or the lowest rate towards its range (three times large than Austrian tax system)

Hence we started to reflect that the Australian model might be a counter British tax system, but the added value in every range after the percentage of the charge, reflected its local difference as insight in either initial tax rate (19%) for the lowest range, as well as the exempted part. Since the exchange rate of the Australia dollar is close to US dollars , but its initial tax rate towards individual is 9% higher, which is due to British tax system. By here we might assumed that the higher exchange rate (higher monetary value) might possess higher initial tax rate. and the exemption of the tax amount might become a safe cursion towards exchange rate fluctuated, since those part of the tax exemption might be not submitted their influence for the government purchase power (either in exchange rate or the amount of the tax charged. )

Would those index formed a domestic comparative consciousness in reflection of the justification of either price level, exchange rate and relative policy for adjustment towards them and individual tax rate?

Comments